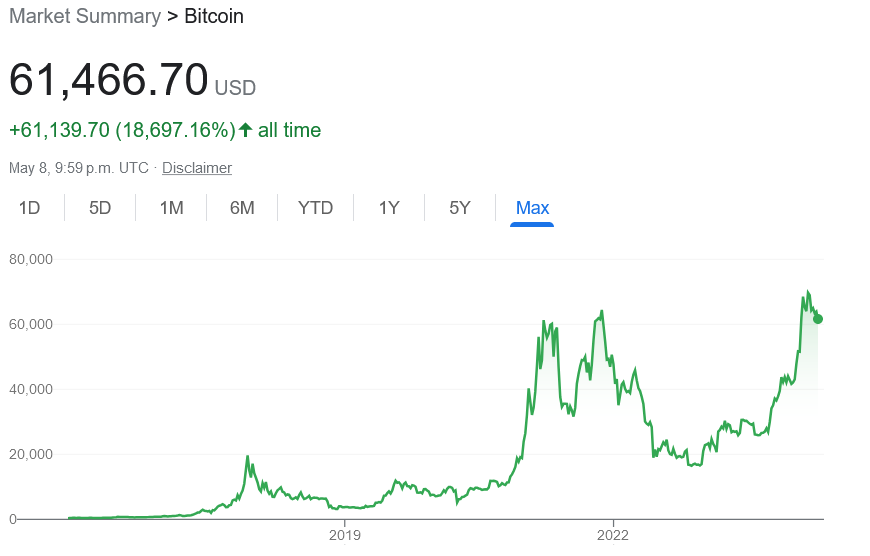

In 2014, the legendary investor Charlie Munger made headlines for his now-famous quote calling Bitcoin “rat poison.” Munger, the vice chairman of Berkshire Hathaway and long-time business partner of Warren Buffet, is known for his straightforward and often controversial remarks on various investment opportunities. His skepticism towards Bitcoin, the world’s most famous cryptocurrency, is just one example of his contrarian views. As of May 8th 2024 the Bitcoin price was 61.4K, that’s an increase of whooping 20,000% since the comment was made by Munger.

Bitcoin, introduced in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, has been a topic of discussion and debate since its inception. It operates on a decentralized network without the need for a central authority, offering users a digital currency that can be used for peer-to-peer transactions without the need for intermediaries like banks. The underlying technology behind Bitcoin, known as blockchain, has also gained attention for its potential applications beyond cryptocurrencies.

Despite the growing popularity of Bitcoin and other cryptocurrencies, Munger has been consistently critical of their value and purpose. In a 2014 interview, he famously referred to Bitcoin as “rat poison,” implying that he sees it as an investment that holds little intrinsic value and is ultimately destined to fail. Munger’s views on Bitcoin are in line with Warren Buffett’s stance on the cryptocurrency, as Buffett has also expressed reservations about investing in assets that lack intrinsic value or generate cash flow.

Munger’s criticism of Bitcoin can be attributed to his belief in traditional investing principles, which focus on companies that have strong fundamentals, sustainable competitive advantages, and the potential for long-term growth. Cryptocurrencies like Bitcoin, in Munger’s view, do not meet these criteria and are therefore not worthy of consideration as investments.

Despite Munger’s negative stance on Bitcoin, its value and popularity have continued to rise in the years since his initial comments. The cryptocurrency has attracted a diverse range of investors, from retail traders to institutional players, who see it as a potentially lucrative asset class with unique properties. The volatility of Bitcoin’s price, however, has led to concerns about its use as a store of value or medium of exchange.

In conclusion, Charlie Munger’s characterization of Bitcoin as “rat poison” reflects his skepticism towards the cryptocurrency and its long-term prospects. While his views may not align with the sentiments of Bitcoin enthusiasts and proponents, they underscore the ongoing debate surrounding the value and utility of cryptocurrencies in the broader investment landscape. Ultimately, whether Bitcoin is a revolutionary innovation or a speculative bubble remains a topic of intense discussion and contention within the financial community.

Leave a Reply